Uncertainty has become the only certainty in construction pricing. The traditional methods of estimating and budgeting are proving inadequate in a market where prices can fluctuate dramatically between concept and completion. This new reality demands a fundamental shift toward greater transparency and precision in how projects are priced from the earliest stages of development.

The Escalating Impact of Construction Costs

As construction prices continue to increase, the eventual cost occupies an increasingly significant role in the viability of every project and development opportunity. Making a proper analysis of costs early in the process has become critical to avoid wasting resources or proceeding with incorrect assumptions. Today’s construction environment presents unprecedented challenges for accurate pricing:

The vast range of construction material choices and options available

Market volatility driven by inflation and anticipated tariffs

Labor constraints and supply chain disruptions

Regulatory changes continuously alter compliance requirements and costs

The Hidden Components That Drive Costs

Beyond the visible elements of any construction project lie numerous systems that significantly impact the total price but are frequently overlooked during conceptual planning:

Ceiling systems, open ceilings, acoustical considerations, decorative lighting

Mechanical and electrical systems

Building automation

Security and access control

Fire protection

Site development requirements

Especially for concept pricing, when full drawings haven’t yet been developed, these “hidden” components need thorough research and consideration. They can dramatically impact the total project cost.

The Industry’s Pricing Dilemma

The construction industry faces a fundamental dilemma in pricing approaches. Many general contracting firms provide artificially low initial estimates to win bids or use a simple cost/square foot to create an estimate, creating a perception of value that rarely materializes. When the true costs inevitably emerge later in the project, clients face difficult decisions: scale back their vision, find additional funding, or abandon the project entirely.

Any contractor can take conceptual information and provide a price that is either so inflated the deal has no chance of succeeding, or low-ball a price that moves things forward but inevitably generates conflicts when reality sets in. Neither approach serves the long-term interests of projects nor instills trust in stakeholders.

Developing Accurate Conceptual Pricing: A Better Approach

So how is it possible to develop accurate, well-qualified conceptual pricing that will hold up over time and remain within an appropriate range of the final construction cost?

The answer lies in deploying experienced professionals to analyze all issues and develop estimates that have real value towards informing budgets long before documentation is complete. This approach includes:

Thoroughly investigating and analyzing existing conditions

Taking time to understand the client’s intent, including practicality, aesthetic, and functional requirements

Engaging trusted subcontractors who can conceptualize the likely end-product and provide realistic current trade pricing

Developing plans and narratives that communicate assumptions so designs can be checked against these guidelines as they develop—the only reliable way to keep a project on budget

Considering costs outside of construction that need to be addressed in the total project budget

Collaborating effectively with design teams to ensure what is drawn aligns with what was priced

The KasCon Approach: Transparency as a Core Value

At KasCon, we’ve built our estimating practices around the principle of transparency. Our process includes:

1. Collaborative Planning: Working closely with clients to define assumptions and create solid pricing that informs decision-making.

2. Detailed Breakdowns: Providing comprehensive, line-item breakdowns of all costs so clients see exactly where their money is going.

3. Uncovering Hidden Costs: Researching and accounting for the less obvious components that significantly impact total project costs.

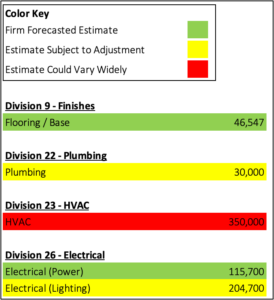

4. Visual Uncertainty Communication: We’ve developed a unique color-coding system that clearly indicates the level of certainty for each line item in our estimates (example on right). Green items represent fixed, highly reliable costs; yellow indicates moderate variability; and red highlights components with significant potential for change due to external factors. This visual approach allows stakeholders to immediately understand which aspects of the estimate carry more risk, facilitating better decision-making.

5. Component-Level Specificity: Rather than relying on broad allowances or industry averages, we create detailed component breakdowns even at the conceptual stage.

For example, our lighting estimates don’t simply apply a per-square-foot allowance.

Instead, we create preliminary lighting layouts based on the intended use and space requirements, then count actual fixture quantities to provide far more accurate pricing (example on left).

We believe that most clients want transparency and accuracy upfront and follow through when it comes time to contract for the work—no surprises and no wasted time chasing unrealistic figures.

The Bottom Line

The most successful projects begin with accurate, transparent pricing that builds trust among all stakeholders. When considering your next construction project, prioritize partners who value transparency, accuracy, and collaborative problem-solving. The initial price tag may appear higher, but the outcome will likely result in a more successful, more cost-effective project.

/wp-content/uploads/2019/03/kascon_logo.png00Jeff Kassman/wp-content/uploads/2019/03/kascon_logo.pngJeff Kassman2025-04-07 15:56:592025-04-08 15:03:30Accurate Construction Budgets Are Make-or-Break for Project Viability in Today’s Market

As we begin 2025, the commercial construction industry is faced with persistent supply chain disruptions, potential tariff impacts, labor shortages, and heightened regulatory scrutiny. These challenges demand a more integrated approach to project leadership—one that maintains consistency from initial concept through final completion.

Supply Chain and Labor Challenges

The post-pandemic construction environment has ushered in a new normal, one of extended timelines and complex logistics. Supply chain disruptions, though improved, continue to impact material delivery patterns. The possibility of new tariffs, particularly affecting trade with Canada, China, and Mexico, threatens to further complicate the situation. These tariffs could significantly impact the availability and cost of essential materials, from mechanical and electrical equipment to basic construction supplies.

Labor shortages, a decade-long challenge, show no signs of abating. The construction industry’s heavy reliance on immigrant labor makes it particularly vulnerable to potential immigration policy changes. Even a modest 3-5% reduction in workforce availability could severely impact project schedules.

In this complex environment, the traditional model of transitioning project leadership between departments—from estimating to pre-construction to construction—creates unnecessary risks. Every construction project is unique, which often requires comprehensive knowledge that can be compromised when leadership changes between project phases.

Consider a scenario where a piece of equipment specified during pre-construction faces potential tariff impacts. A project leader with continuous involvement from concept through completion can:

Immediately identify potential supply chain risks

Evaluate alternative equipment options while understanding their broader impact on permits and drawings

Navigate jurisdiction-specific requirements for equipment changes

Maintain clear communication with all stakeholders throughout the process

Meeting Modern Regulatory Demands

Today’s construction projects face intensified regulatory oversight, partly driven by high-profile incidents that have prompted jurisdictions to enhance their scrutiny. Fire marshals, building inspectors, and other regulatory authorities are more particular than they were even five years ago. This heightened attention to detail, while necessary for safety, creates tension with clients’ desires for faster project completion.

A consistent project leader who understands these regulatory nuances from the outset can:

Anticipate jurisdiction-specific requirements

Integrate compliance considerations into early planning

Coordinate effectively with third-party inspectors when needed

The KasCon Leadership Model

KasCon’s longstanding philosophy of maintaining singular leadership from concept estimate through completion has proven particularly prescient in today’s challenging environment. Unlike the typical general contractor model, which often doesn’t involve project managers until construction is ready to begin, KasCon’s approach ensures comprehensive project understanding from day one. This model, while requiring greater upfront investment in experienced leadership, has consistently delivered superior results, including:

Faster decision-making and problem resolution

Reduced information loss between project phases

More efficient risk management

Enhanced client satisfaction through single-point accountability

Eliminated orientation periods between leadership transitions

Looking Ahead

As we progress through 2025, the complexity of construction projects shows no signs of diminishing. The industry faces continuing pressures from supply chain uncertainties, workforce challenges, and intensifying regulatory requirements. In this environment, maintaining consistent leadership throughout a project’s lifecycle isn’t just beneficial—it’s becoming essential for successful project delivery.

/wp-content/uploads/2019/03/kascon_logo.png00Jeff Kassman/wp-content/uploads/2019/03/kascon_logo.pngJeff Kassman2025-01-21 15:29:452025-04-07 15:58:23Consistent Project Leadership: A Critical Strategy for Managing Construction Complexity in 2025

In today’s rapidly evolving healthcare landscape, the demand for outpatient and ambulatory care services continues to grow. The construction of these facilities in the post-pandemic world remains challenging on several fronts. As a leading medical facility general contractor in Maryland, KasCon, Inc. offers clients expert assistance in navigating the complexity of facility construction.

Growth in Demand for Outpatient Facilities

The demand for outpatient facilities and ambulatory care centers is growing. Insurance companies are increasingly discouraging the use of hospital emergency rooms, driving the demand to construct more urgent care facilities. Procedures such as knee and hip replacements, previously relegated to hospitals, are now being performed in the outpatient environment. Increased awareness of the value of routine testing as a preventative measure places increased demands on existing outpatient facilities and drives the need for larger, efficient spaces.

Unique Needs of Healthcare Facilities

Healthcare facilities have always had unique construction requirements which have grown substantially since the pandemic. Sanitization and easy-to-clean surfaces have been a mainstay of all healthcare environments, but a heightened focus on infection control has made these concerns more important. Quality ventilation systems and advanced air filtration have become standard, ensuring safer facilities. Hands free technology, back-up power systems, radiation protection, and structural demands are common to many ambulatory healthcare projects and those needs have not relaxed or changed. These trends all contribute to rising construction costs.

Navigating the “Perfect Storm” of Cost Pressures

Medical construction projects today face a “perfect storm” of cost pressures:

MEP: Mechanical, electrical, and plumbing systems have seen the most significant cost increases post-pandemic and are dominant elements in all healthcare projects.

Aesthetic Considerations: There’s a growing emphasis on creating appealing “front of house” areas with high-end, expensive finishes to attract and maintain patients.

Infection Control & Safety Best Practices: Meeting new requirements for infection control and other safety measures contributes to rising costs.

Predicting these increased materials costs is critical to predicting overall construction costs to prepare and meet accurate budgets.

The KasCon Advantage: Strategic Pre-Construction Planning and Proactive Problem Solving

At KasCon, we understand that navigating these multifaceted challenges requires more than just construction expertise – it demands a comprehensive, strategic approach. That’s why we place critical importance on thorough pre-construction planning. Our process involves detailed budgeting with comprehensive cost analysis from the project’s outset, expert guidance through the complex web of healthcare construction regulations, and innovative solutions leveraging our years of experience. We work collaboratively with healthcare providers, architects, and regulators to ensure all needs are met efficiently and cost-effectively.

KasCon understands how, and when, all the elements of a project need to fit together and works to proactively overcome any challenges. Some examples include:

Identifying and pre-ordering mechanical equipment with a long-lead time to ensure a project stays on schedule

Reworking electrical distribution to utilize more readily available equipment

Implementing temporary solutions to keep a project on track, e.g. lining an x-ray room door with lead to make the site functional, while waiting or a back-ordered custom lead-lined door

Partnering for Success in Medical Construction

As the medical construction landscape continues to evolve, specialized expertise like KasCon’s becomes increasingly valuable. By understanding the unique challenges of outpatient and ambulatory facility construction and employing meticulous planning and innovative problem-solving, we help healthcare providers navigate this complex landscape of cost pressures and regulatory demands.

For healthcare providers looking to build or renovate outpatient facilities in Maryland, partnering with an experienced firm like KasCon can make the difference between a challenging, costly process and a smooth, successful project that meets all regulatory, functional, and budgetary requirements.

/wp-content/uploads/2019/03/kascon_logo.png00Jeff Kassman/wp-content/uploads/2019/03/kascon_logo.pngJeff Kassman2024-10-22 21:41:262025-04-07 15:58:35Navigating the Complexities of Outpatient Healthcare Construction

Accurate Construction Budgets Are Make-or-Break for Project Viability in Today’s Market

Uncertainty has become the only certainty in construction pricing. The traditional methods of estimating and budgeting are proving inadequate in a market where prices can fluctuate dramatically between concept and completion. This new reality demands a fundamental shift toward greater transparency and precision in how projects are priced from the earliest stages of development.

The Escalating Impact of Construction Costs

As construction prices continue to increase, the eventual cost occupies an increasingly significant role in the viability of every project and development opportunity. Making a proper analysis of costs early in the process has become critical to avoid wasting resources or proceeding with incorrect assumptions. Today’s construction environment presents unprecedented challenges for accurate pricing:

The Hidden Components That Drive Costs

Beyond the visible elements of any construction project lie numerous systems that significantly impact the total price but are frequently overlooked during conceptual planning:

Especially for concept pricing, when full drawings haven’t yet been developed, these “hidden” components need thorough research and consideration. They can dramatically impact the total project cost.

The Industry’s Pricing Dilemma

The construction industry faces a fundamental dilemma in pricing approaches. Many general contracting firms provide artificially low initial estimates to win bids or use a simple cost/square foot to create an estimate, creating a perception of value that rarely materializes. When the true costs inevitably emerge later in the project, clients face difficult decisions: scale back their vision, find additional funding, or abandon the project entirely.

Any contractor can take conceptual information and provide a price that is either so inflated the deal has no chance of succeeding, or low-ball a price that moves things forward but inevitably generates conflicts when reality sets in. Neither approach serves the long-term interests of projects nor instills trust in stakeholders.

Developing Accurate Conceptual Pricing: A Better Approach

So how is it possible to develop accurate, well-qualified conceptual pricing that will hold up over time and remain within an appropriate range of the final construction cost?

The answer lies in deploying experienced professionals to analyze all issues and develop estimates that have real value towards informing budgets long before documentation is complete. This approach includes:

The KasCon Approach: Transparency as a Core Value

At KasCon, we’ve built our estimating practices around the principle of transparency. Our process includes:

1. Collaborative Planning: Working closely with clients to define assumptions and create solid pricing that informs decision-making.

2. Detailed Breakdowns: Providing comprehensive, line-item breakdowns of all costs so clients see exactly where their money is going.

3. Uncovering Hidden Costs: Researching and accounting for the less obvious components that significantly impact total project costs.

4. Visual Uncertainty Communication: We’ve developed a unique color-coding system that clearly indicates the level of certainty for each line item in our estimates (example on right). Green items represent fixed, highly reliable costs; yellow indicates moderate variability; and red highlights components with significant potential for change due to external factors. This visual approach allows stakeholders to immediately understand which aspects of the estimate carry more risk, facilitating better decision-making.

5. Component-Level Specificity: Rather than relying on broad allowances or industry averages, we create detailed component breakdowns even at the conceptual stage.

For example, our lighting estimates don’t simply apply a per-square-foot allowance.

We believe that most clients want transparency and accuracy upfront and follow through when it comes time to contract for the work—no surprises and no wasted time chasing unrealistic figures.

The Bottom Line

The most successful projects begin with accurate, transparent pricing that builds trust among all stakeholders. When considering your next construction project, prioritize partners who value transparency, accuracy, and collaborative problem-solving. The initial price tag may appear higher, but the outcome will likely result in a more successful, more cost-effective project.

Consistent Project Leadership: A Critical Strategy for Managing Construction Complexity in 2025

As we begin 2025, the commercial construction industry is faced with persistent supply chain disruptions, potential tariff impacts, labor shortages, and heightened regulatory scrutiny. These challenges demand a more integrated approach to project leadership—one that maintains consistency from initial concept through final completion.

Supply Chain and Labor Challenges

The post-pandemic construction environment has ushered in a new normal, one of extended timelines and complex logistics. Supply chain disruptions, though improved, continue to impact material delivery patterns. The possibility of new tariffs, particularly affecting trade with Canada, China, and Mexico, threatens to further complicate the situation. These tariffs could significantly impact the availability and cost of essential materials, from mechanical and electrical equipment to basic construction supplies.

Labor shortages, a decade-long challenge, show no signs of abating. The construction industry’s heavy reliance on immigrant labor makes it particularly vulnerable to potential immigration policy changes. Even a modest 3-5% reduction in workforce availability could severely impact project schedules.

In this complex environment, the traditional model of transitioning project leadership between departments—from estimating to pre-construction to construction—creates unnecessary risks. Every construction project is unique, which often requires comprehensive knowledge that can be compromised when leadership changes between project phases.

Consider a scenario where a piece of equipment specified during pre-construction faces potential tariff impacts. A project leader with continuous involvement from concept through completion can:

Meeting Modern Regulatory Demands

Today’s construction projects face intensified regulatory oversight, partly driven by high-profile incidents that have prompted jurisdictions to enhance their scrutiny. Fire marshals, building inspectors, and other regulatory authorities are more particular than they were even five years ago. This heightened attention to detail, while necessary for safety, creates tension with clients’ desires for faster project completion.

A consistent project leader who understands these regulatory nuances from the outset can:

The KasCon Leadership Model

KasCon’s longstanding philosophy of maintaining singular leadership from concept estimate through completion has proven particularly prescient in today’s challenging environment. Unlike the typical general contractor model, which often doesn’t involve project managers until construction is ready to begin, KasCon’s approach ensures comprehensive project understanding from day one. This model, while requiring greater upfront investment in experienced leadership, has consistently delivered superior results, including:

Looking Ahead

As we progress through 2025, the complexity of construction projects shows no signs of diminishing. The industry faces continuing pressures from supply chain uncertainties, workforce challenges, and intensifying regulatory requirements. In this environment, maintaining consistent leadership throughout a project’s lifecycle isn’t just beneficial—it’s becoming essential for successful project delivery.

Navigating the Complexities of Outpatient Healthcare Construction

In today’s rapidly evolving healthcare landscape, the demand for outpatient and ambulatory care services continues to grow. The construction of these facilities in the post-pandemic world remains challenging on several fronts. As a leading medical facility general contractor in Maryland, KasCon, Inc. offers clients expert assistance in navigating the complexity of facility construction.

Growth in Demand for Outpatient Facilities

The demand for outpatient facilities and ambulatory care centers is growing. Insurance companies are increasingly discouraging the use of hospital emergency rooms, driving the demand to construct more urgent care facilities. Procedures such as knee and hip replacements, previously relegated to hospitals, are now being performed in the outpatient environment. Increased awareness of the value of routine testing as a preventative measure places increased demands on existing outpatient facilities and drives the need for larger, efficient spaces.

Unique Needs of Healthcare Facilities

Healthcare facilities have always had unique construction requirements which have grown substantially since the pandemic. Sanitization and easy-to-clean surfaces have been a mainstay of all healthcare environments, but a heightened focus on infection control has made these concerns more important. Quality ventilation systems and advanced air filtration have become standard, ensuring safer facilities. Hands free technology, back-up power systems, radiation protection, and structural demands are common to many ambulatory healthcare projects and those needs have not relaxed or changed. These trends all contribute to rising construction costs.

Navigating the “Perfect Storm” of Cost Pressures

Medical construction projects today face a “perfect storm” of cost pressures:

Predicting these increased materials costs is critical to predicting overall construction costs to prepare and meet accurate budgets.

The KasCon Advantage: Strategic Pre-Construction Planning and Proactive Problem Solving

At KasCon, we understand that navigating these multifaceted challenges requires more than just construction expertise – it demands a comprehensive, strategic approach. That’s why we place critical importance on thorough pre-construction planning. Our process involves detailed budgeting with comprehensive cost analysis from the project’s outset, expert guidance through the complex web of healthcare construction regulations, and innovative solutions leveraging our years of experience. We work collaboratively with healthcare providers, architects, and regulators to ensure all needs are met efficiently and cost-effectively.

KasCon understands how, and when, all the elements of a project need to fit together and works to proactively overcome any challenges. Some examples include:

Partnering for Success in Medical Construction

As the medical construction landscape continues to evolve, specialized expertise like KasCon’s becomes increasingly valuable. By understanding the unique challenges of outpatient and ambulatory facility construction and employing meticulous planning and innovative problem-solving, we help healthcare providers navigate this complex landscape of cost pressures and regulatory demands.

For healthcare providers looking to build or renovate outpatient facilities in Maryland, partnering with an experienced firm like KasCon can make the difference between a challenging, costly process and a smooth, successful project that meets all regulatory, functional, and budgetary requirements.